Filing an insurance claim is a complex and time-consuming process. In stressful situations, such as an accident, a health emergency, or unexpected damage, customers want quick answers, transparent communication, and effective guidance. But generally, they get trapped in confusion and endless paperwork, leaving the customers in a frustrated state. According to a report, incomplete or missing documentation accounts for 25% of billing errors that lead to delays in insurance processes.

That’s where AI automated claims management and automated insurance claims systems are making a real difference. These intelligent, mobile-powered tools are leading the insurance digital transformation by simplifying both claims and AI in underwriting. Instead of relying on manual steps, AI for claims processing simplifies the complex process, such as collecting data, assessing damage, verifying documents, and even making informed decisions in real time.

These AI agents work around the clock to accelerate automated insurance claims processes, improve consistency, and reduce errors. By automating repetitive back-end tasks such as document automation for underwriting, insurers free up human agents to focus on empathy and support during claims—a win for both sides.

The traditional claims and AI in underwriting workflows simply can’t meet today’s expectations. Thanks to insurance digital transformation, what was once a paper-heavy, frustrating ordeal has become a faster, more intuitive experience powered by AI, automated claims management, and automated document processing. Advanced AI software development services, machine learning, and data analytics can help insurance companies automate insurance claims, reduce errors, and drive operational efficiency.

Common Challenges in Traditional Insurance Claim Processing

Filing automated insurance claims is still not easy for many. Policyholders face delays, unclear communication, and paperwork overload, while insurers deal with data silos and time-consuming manual tasks. The lack of document automation for underwriting and proper AI for claims processing tools makes things worse.

So, what’s holding the traditional claim process back?

1. Too Many Manual Steps

From submitting the claim to collecting documents, reviewing details, verifying information, and waiting for approvals, every step takes time. Without automated document processing in insurance, delays are nearly inevitable.

2. No Way to Track Progress

Policyholders are often left guessing about the status of their automated insurance claims, especially without tools driven by AI in underwriting or artificial intelligence in insurance.

3. Inconsistent Assessments

Decisions depend on individual judgment. That means two similar claims might end up with very different outcomes, simply based on who handles them. AI automated claims management offers a more consistent and transparent approach.

4. Late Fraud Detection

Without AI in underwriting and fraud analytics, fraudulent claims can pass through undetected. Without tools to identify unusual patterns early, suspicious claims may slip through or get caught too late. Artificial intelligence in insurance enhances fraud detection using historical patterns.

5. Poor Customer Experience

Long waits, repeated paperwork, and unclear communication leave policyholders disappointed. Many end up losing trust in the insurer and look elsewhere for better service. Insurance digital transformation tools using AI for claims processing and automated insurance claims help fix that.

Moving Toward a Better Way: To overcome these challenges, insurance providers are simplifying and improving how claims are handled. Insurers are embracing document automation for insurance and shifting to automated document processing insurance systems powered by artificial intelligence in insurance. By switching to more digital, streamlined processes, insurers can process claims faster, reduce errors, and provide clearer communication.

This shift doesn’t just benefit the back office—it also gives policyholders a smoother, more reliable experience when they need it most.

What are AI agents in insurance?

AI agents are transforming insurance digital transformation initiatives using technologies like machine learning, predictive analytics, and natural language processing to support and enhance various insurance functions. These intelligent tools are built to replicate human-like thinking, such as analyzing, learning, and making decisions, while handling large volumes of data quickly and without emotional or personal bias.

Autonomous AI agents use artificial intelligence in insurance to process vast datasets, provide insights, and automate decisions.

From managing customer interactions and processing claims to identifying potential fraud, AI agents are capable of making insurance operations more efficient, accurate, and customer-friendly.

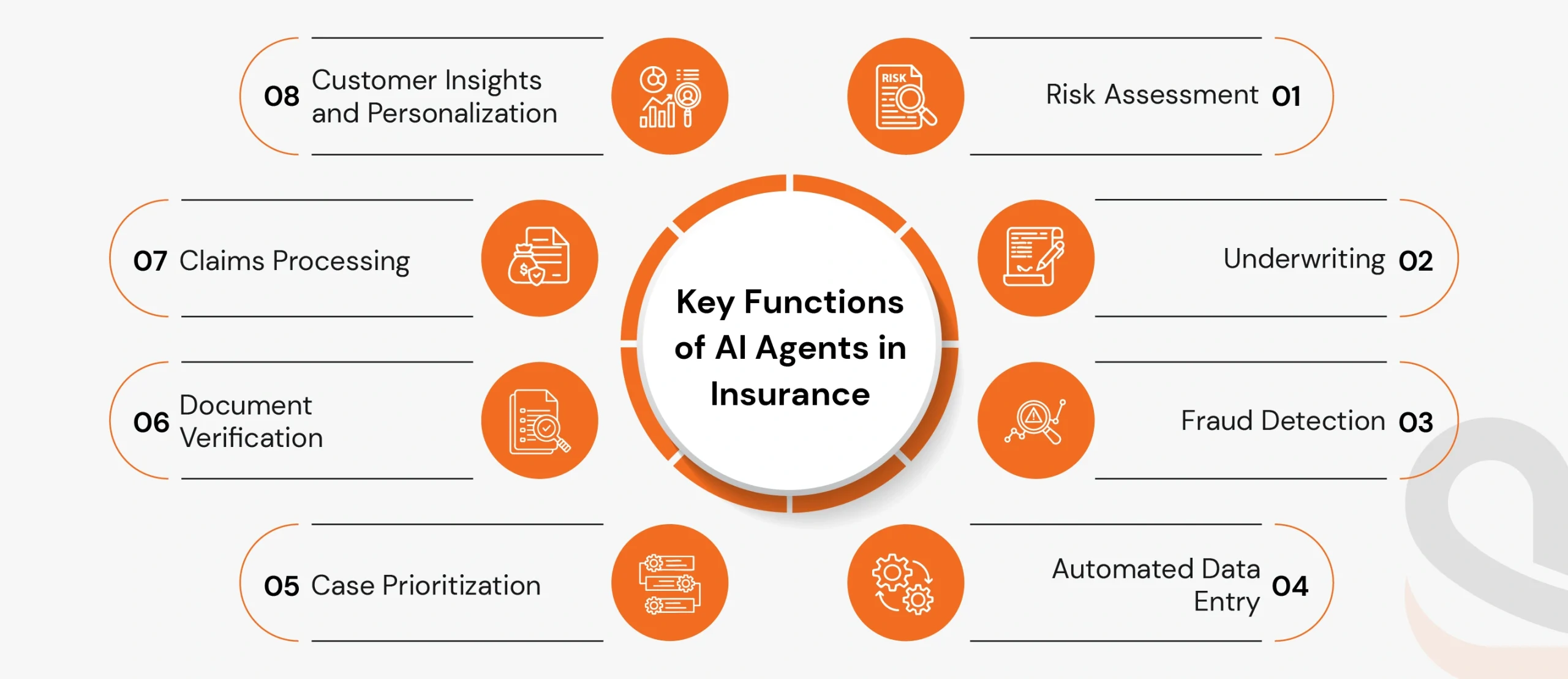

Key Functions of AI Agents in Insurance

Risk Assessment

AI agents help insurers evaluate risk more accurately by analyzing large volumes of data, such as past claims, customer behavior, and industry trends. Using predictive models, artificial intelligence in insurance forecasts potential risks and assists in setting fair, data-driven premiums for customers.

Underwriting

These digital agents support underwriters by quickly processing and reviewing complex datasets. AI in underwriting assesses the risks linked to insuring a person or business, helping to speed up the underwriting process and ensure faster policy approvals.

Fraud Detection

AI agents can spot unusual patterns and inconsistencies in claims or transactions that may indicate fraud with AI automated claims management. As they continue to learn and adapt, they become better at identifying new fraud methods, helping insurers strengthen their fraud prevention efforts.

Automated Data Entry

AI agents assist insurers with automated document processing, which includes extracting and entering data gathered from claims. AI agents help automate repetitive tasks, accelerating the processing times and enhancing the overall productivity.

Case Prioritization

Autonomous agents ensure high-impact cases are addressed first by prioritizing claims based on complexity and urgency. This triage process is a core part of AI automated claims management, improving both response times and customer satisfaction. In turn, insurers benefit from faster resolutions and more accurate decision-making, two key aspects of AI in underwriting and AI for claims processing.

Document Verification

AI agents can enhance the accuracy of the submitted documents by cross-checking it meticulously against regulatory and policy requirements. Implemeting document automation for underwriting eradicates unnecessary delays and make document verification process more quick as well as secure by reducing the risk of fraud and error.

Claims Processing

From collecting and verifying information to conducting initial evaluations, AI agents handle many steps in the claims process automatically. Automated document processing insurance reduces delays, minimizes mistakes, and helps customers get faster, more accurate responses.

Customer Insights and Personalization

AI agents help insurers to understand their customers in a better way by analyzing customer data and identifying hidden patterns. Insurers can also tailor their products and services with automated insurance claims, paving the way for more personalized offerings.

-

- See How Agentic AI Is Already Transforming Businesses Like Yours

Read: Agentic AI For Business Transformation

- See How Agentic AI Is Already Transforming Businesses Like Yours

Applications of AI Agents in Automated Insurance Claims

AI agents are helping reshape the insurance industry by handling routine tasks, improving decisions, and offering better experiences for both customers and staff. Below are some of the key areas where AI agents are making a difference:

1. Claims Processing and Management

a. Faster Claims Assessment

With AI for claims processing, AI agents speed up the claims process by automatically reviewing and verifying claims. They pull and check details from sources like medical records, accident reports, and policy documents. They reduce errors, speed up automated insurance claims, and support timely responses using automated document processing insurance.

b. Spotting Fraud

AI agents help protect insurers from financial fraud by identifying unusual patterns in AI automated claims management. Artificial intelligence in insurance analyzes anomalies and data irregularities in the claims that may involve fraud.

2. Underwriting and Risk Assessment

a. Smarter Risk Evaluation

AI agents are capable of analyzing a wide range of customer data, such as credit scores, lifestyle habits, medical history, and other information, to evaluate the risk of insuring that particular customer. Such detailed evaluation and deep data analysis with AI in underwriting leads to more accurate premium pricing and better risk control.

b. Predicting Trends

Through artificial intelligence in insurance, agents forecast risks and trends, driving better insurance digital transformation strategies and pricing models. This allows companies to adjust their underwriting strategies to better prepare for possible claims spikes or changing market conditions.

3. Customer Service and Engagement

a. Chatbots for Instant Help

Chatbots powered by artificial intelligence in insurance can answer customer questions 24*7. They assist with things like policy details, claim updates, and FAQs—freeing up human agents to deal with more complex issues.

b. Personalized Support

Customer interactions, such as policy change recommendations and sending reminders, can be tailored with AI agents using customer data. Such interactions give a personal touch that helps build trust and customer loyalty by integrating document automation for insurance.

4. Marketing and Sales

a. Targeted Campaigns

Analyzing customer behaviour and preference with the help of AI agents enables insurers to run more focused marketing campaigns. This ensures messages reach the right people with the right offer. Artificial intelligence in insurance identifies audience segments and delivers personalized marketing using behavioral insights.

b. Lead Prioritization

Using AI in underwriting data, AI agents can score leads by analyzing things like website activity and past interactions. This helps insurance sales teams to stay focused on the most likely prospects, improving conversion rates.

5. Policy Management

a. Renewal Reminders

AI agents provide timely alerts about upcoming renewals, a core feature of insurance digital transformation and customer retention.

b. Fast Policy Issuance

Using document automation for underwriting, insurers can auto-fill forms and issue policies more efficiently with automated document processing insurance.

6. Regulatory Compliance

a. Monitoring for Compliance

AI agents keep track of internal processes to ensure everything aligns with industry regulations. AI for claims processing ensures processes meet legal standards and reduces audit risks. This minimizes legal risks and helps companies avoid penalties.

b. Automated Reporting

They also prepare compliance reports accurately and on time, making it easier for insurers to stay transparent and audit-ready. AI prepares compliance documents using document automation for insurance, simplifying reporting and reducing manual work.

7. Risk Mitigation and Prevention

a. Predictive Maintenance

For insurers covering equipment or machinery, AI agents can predict when maintenance is needed. By analyzing sensor data, AI automated claims management can alert clients before issues arise, helping prevent costly repairs and claims.

b. Real-Time Risk Monitoring

AI agents can monitor risk factors in real time, such as weather conditions, driver behavior, or operational anomalies, depending on the type of insurance coverage. This enables insurers and policyholders to take immediate preventive actions, reducing the likelihood of incidents and minimizing potential losses.

8. Data Management and Insights

a. Organizing Data Efficiently

AI agents help gather and clean up data from different systems. This improves the quality and reliability of information used in daily operations. With document automation for insurance, agents clean and structure data for more efficient workflows.

b. Drawing Insights from Data

They can also dig through large volumes of data to uncover trends and insights. Insights powered by artificial intelligence in insurance help insurers refine services, pricing, and outreach strategies.

Conclusion

From simplifying back-end processes to enhancing customer satisfaction, AI agents are becoming the reliable digital coworkers across the insurance industry. Artificial intelligence in insurance helps enhance operational efficiency, reduce risk, and deliver better services. AI agents can work for both insurers and customers, making the overall insurance process simple, quick, and accurate. Contact us to embrace the exponential possibilities of artificial intelligence in insurance and elevate your entire insurance process to the next level, digitally. Navigate through our AI portfolio to explore our AI capabilities and projects our team of experts has worked on.