Being an insurance agent isn’t easy. Most agents spend their days juggling phone calls, meeting clients, handling paperwork, sending follow-up emails, and chasing policy renewals. It’s a busy and stressful job. Even though the goal is to find new clients and grow your business, so much time gets lost in doing small, repetitive tasks.

This is where technology, especially artificial intelligence (AI), can make a big difference. Today, AI for insurance is transforming how agents work, making their tasks faster, smarter, and more efficient.

As per the report by Allianz Commercial, by 2027, the market potential of generative AI in insurance and finance industries is estimated to reach $32 billion 2027.

There are powerful mobile apps built with AI tools for insurance agents that can help save time, stay organized, and work more efficiently. These apps for insurance can do things like manage client data, track sales, send reminders, and even answer customer questions automatically. With many agents now working from home or on the move, having the best insurance app with AI features is more important than ever.

Using AI-powered apps isn’t just about saving time. it’s about helping you focus on what really matters: talking to clients, building relationships, and closing deals. In this blog, we’ll look at the best AI for insurance agents through the top 6 mobile applications every insurance professional should consider using.

6 Essential Mobile Apps For Insurance Agents

For better insurance services and accuracy, insurance agents should have these AI-powered apps for insurance with them to improve customer satisfaction and increase policy conversion rates. With the growing adoption of AI in the insurance industry, these apps represent the best AI for insurance agents who want to stay ahead of their competitors.

1. Customer Relationship Management (CRM) App

CRM app helps insurance agents organize and manage all interactions with leads and clients in one place. This app stores contact details, tracks communication history, schedules follow-ups, and even automates email campaigns. Many modern CRM apps use AI for insurance to analyze customer behavior, prioritize important leads, and recommend the best time to contact clients. This kind of insurance app helps deliver more efficient insurance services to clients.

Benefits:

- Centralized client database

- Automated follow-ups and reminders

- Better client engagement through personalization

- Increased sales through lead tracking and nurturing

- Improved client retention and satisfaction

- Clear insights into sales performance

How AI Enhances the App Capabilities:

AI tools for insurance agents help CRM apps score leads based on engagement, predict churn risks, and suggest optimal communication times. These smart suggestions make CRM one of the best insurance apps that boost productivity and results.

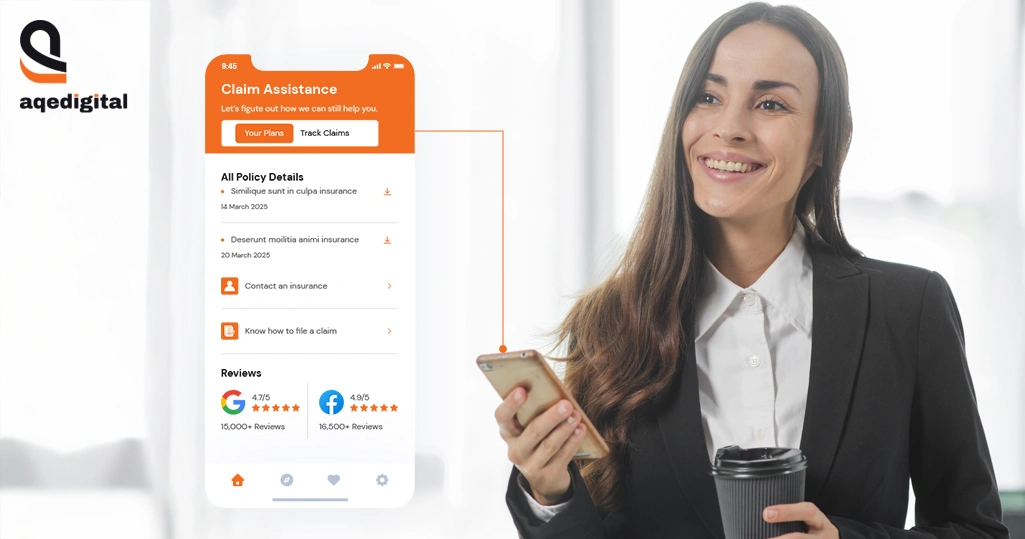

2. Claims Management App

Claims management app streamlines the end-to-end process of filing, reviewing, and resolving insurance claims. Agents can submit claims directly from their mobile device, attach documents, and monitor progress in real time. Built-in AI for insurance agents allows the app to pre-screen claims, detect fraud, and simplify communication. Insurance agents can make faster and better decisions using AI in the insurance industry. Such a claims management app helps reduce the need for back-and-forth communication and automatically updates the client about their claim status.

Benefits:

- Faster claims processing with reduced manual tasks

- Real-time updates to keep clients informed

- Reduced paperwork and errors

- Reduced claim cycle time and operational costs

- Improved customer satisfaction

- Better compliance tracking

How AI Enhances the App Capabilities:

Insurance agents using an AI-empowered claim management app can analyze the data of claims to identify anomalies and act proactively to prevent potential fraud. With such AI-empowered advanced capabilities, it becomes the best insurance app to manage, streamline, and support the insurance claims process.

3. Insurance Policy Management App

Insurance agents can manage all activities related to policy from a single dashboard with an insurance policy management app. The activities could include viewing policies, updating information, initiating renewals, document management and etc. With AI in the insurance industry, the app can alert you about policies nearing expiration and recommend clients for upgrades, helping agents stay proactive.

Benefits:

- Easy unified access to all policy details

- Automated alerts for renewals and lapses

- Quick policy edits or updates without calling support

- Better policy accuracy and fewer human errors

- Streamlined policy lifecycle management

- Increased renewals and client retention

How AI Enhances the App Capabilities:

AI enables predictive policy alerts and smart recommendations for upselling or cross-selling based on client behavior and purchase history. It also automates policy document generation and reduces manual intervention in updates. This AI for insurance functionality improves client engagement and retention, making it one of the best AI for insurance agents.

4. Document Management App

This app for insurance helps agents store, organize, and share important documents. Agents can securely manage ID proofs, signed forms, and policy contracts. The use of AI for insurance agents makes it easier to tag and find documents instantly. AI-powered features allow for smart categorization, instant search, and even data

extraction from scanned documents.

Benefits:

- No more paper clutter or lost files

- Secure, cloud-based access to documents anytime

- Faster document retrieval with AI-powered search

- Improved data security and compliance

- Reduced administrative overhead

- Easier auditing and documentation tracking

How AI Enhances the App Capabilities:

AI can read, classify, and tag documents automatically, making it easy to find files using natural language search. It can also extract key data from PDFs or images, reducing manual data entry and human errors.

5. Mobile Quoting App

Mobile quoting apps enable insurance agents to generate instant quotes based on client information entered via a mobile device. This app often supports side-by-side plan comparisons and includes calculators for premiums, discounts, and coverage limits. Some apps are linked to multiple insurance providers, helping agents offer the best policy options on the spot. With integrated AI tools for insurance agents, the app suggests accurate quotes and even highlights upsell chances.

Benefits:

- Quick and accurate quotes while meeting clients

- Better conversion rates

- Ability to close sales on the spot

- Higher lead-to-policy conversion rates

- Shortened sales cycles

How AI Enhances the App Capabilities:

Insurance agents can quickly access dynamic pricing based on customer profiles and market trends with AI-integrated quoting apps. Additionally, having such an advanced app can help agents by suggesting personalized product combinations and detecting incorrect or missing client inputs instantly.

6. Risk Assessment and Underwriting App

Risk assessment and underwriting apps use AI and big data to evaluate the risk profile of potential policyholders. Such AI-powered apps analyze personal and financial data, medical records, driving history, and other risk factors to calculate accurate premiums and underwriting decisions. Insurance agents can process faster approvals and transparency in decision-making by leveraging predictive analytics and scoring systems available in the app.

Benefits:

- Faster risk evaluation and decision-making

- Instant access to underwriting recommendations

- Less back-and-forth with underwriters

- More accurate pricing and reduced risk exposure

- Streamlined underwriting process

- Lower claim ratios due to better risk profiling

How AI Enhances the App Capabilities:

With AI models in place, it is possible to get multiple data points analyzed and calculate the risk scores for specific policies and make underwriting decisions. These models learn from past claims and reduce biased decisions, leading to improved accuracy and impartial assessments.

Conclusion

Mobile applications are playing an instrumental role in this rapidly evolving insurance industry, and AI is increasing the importance and effectiveness of mobile applications. Adopting appropriate and relevant technology can help insurance agents to streamline workflows, enhance conversion rates, and reduce administrative burden by automating repetitive and time-consuming tasks. AQe Digital, as an AI software development services provider, can help you develop AI-empowered mobile applications to drive business growth and digital transformation, making your business future-ready.